Global Expansion Resources | Australia

Australia Entity Setup

Expand into Australia with the leading Australia Entity Setup company

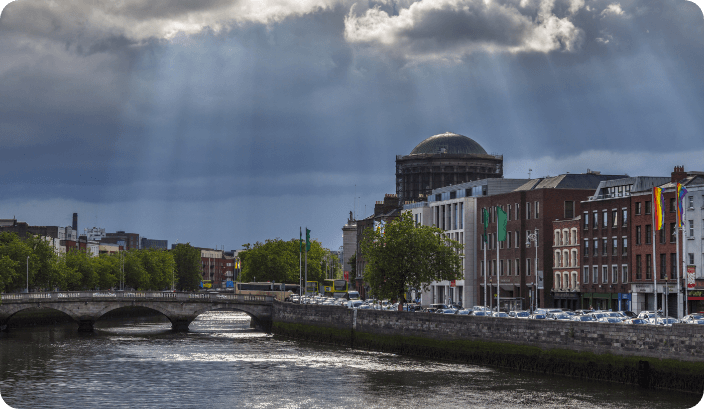

Planning to expand into Australia?

With a stable economy, a highly skilled English-speaking workforce and close trade links across the Asia-Pacific, Australia remains one of the most attractive destinations for international expansion.

If you are thinking about moving business operations into Australia, you’ll need to decide whether to establish a legal entity or partner with a PEO (Professional Employer Organisation).

There are pros and cons to both options, with different degrees of compliance and cost involved. The Leap29 expansion team can help you decide which is the best option for your business.

Want to expand into Australia?

Contact us today to see how Leap29 can be the trusted partner that supports your global expansion.

"*" indicates required fields

What’s included:

HR software

Bespoke employee management software included in our PEO service.

Global compliance

We have expert teams across the world to ensure global compliance.

Transparent pricing

Avoid hidden costs and account for our fee with our transparent pricing.

Australia Expansion Advice

Who needs to set up an entity in Australia?

If your business plans to trade directly in Australia, employ local staff or open a physical office, you’ll need to register a local company. This ensures compliance with Australian tax and employment laws such as the Australian Taxation Office (ATO) and Superannuation. It can also help build trust with local clients and partners.

If your only connection to Australia is through independent contractors and you’re not managing operations on the ground, setting up a legal entity is usually unnecessary.

Types of Australian business entity structures for foreign companies expanding

Foreign companies expanding into Australia will typically choose one of the following company structures:

- Proprietary Limited Company (Pty Ltd) – This is the most common type of entity for foreign investors. It offers limited liability to shareholders and flexibility for small to medium-sized operations. A Pty Ltd company must have at least one director who ordinarily resides in Australia. It is treated as a separate legal entity for tax and legal purposes.

- Australian Subsidiary Company – An Australian subsidiary is a locally incorporated company controlled by a foreign parent. It operates as an independent legal entity under Australian law, meaning the parent company’s liability is limited to its investment. This structure is preferred when a foreign business wants full control over its local operations while maintaining legal separation from the parent entity.

- Branch Office – A branch is an extension of an overseas parent company rather than a separate legal entity. It can carry out business activities in Australia but must be enrolled as a Registered Foreign Company with the Australian Securities and Investments Commission (ASIC) to do so. However, unlike a subsidiary, a branch does not offer limited liability protection to the parent company, as the parent remains legally responsible for the branch’s obligations.

- Registered Foreign Company – A foreign company that wishes to conduct business directly in Australia without incorporating a local entity must register with ASIC as a Registered Foreign Company under the Corporations Act 2001. It must appoint a local agent who can act on behalf of the company and ensure compliance with Australian reporting and disclosure requirements.

The right structure depends on your long-term goals, the level of control you want to maintain, and how you plan to operate within Australia’s regulatory and tax frameworks.

What are the benefits of setting up a business in Australia?

Australia offers a stable and lucrative economy for international companies looking to expand in the Asia-Pacific region. Key advantages include:

- Competitive corporation tax rate (currently 30% or 25% for base rate entities).

- Good access to major Asia-Pacific markets through trade and investment agreements.

- Strong sectors in resources, technology, healthcare and financial services.

- A highly skilled and English-speaking workforce.

For global companies wanting to expand, Australia offers a gateway to the profitable Asia-Pacific economy that values innovation and long-term investment.

How to register a company in Australia

Setting up a subsidiary or new company in Australia involves several steps:

- Registering with the Australian Securities and Investments Commission (ASIC) to obtain an Australian Company Number (ACN).

- Submit incorporation documents, including the company constitution and details of shareholders and directors.

- Appoint at least one director who ordinarily resides in Australia.

- Register for an Australian Business Number (ABN) and Tax File Number (TFN) with the Australian Taxation Office (ATO).

- Open a local business bank account in the company’s name.

- Secure a registered office address in Australia for official correspondence.

Depending on your industry, you may also need specific licences or regulatory approvals before commencing operations in Australia. This overview covers some of the main steps – for tailored support with your entity setup, contact our expansion team.

Why use a PEO instead of setting up a legal entity in Australia?

Establishing a local entity provides permanence and long-term stability but also brings cost, time and compliance obligations. If your goal is to test the Australian market, hire quickly or expand without heavy administration, using a Professional Employer Organisation (PEO) can be a practical and cheaper alternative.

With a PEO you can:

- Hire employees in Australia without setting up a company

- Manage payroll, taxes and HR compliance seamlessly

- Scale up or down quickly depending on business performance

- Avoid the risks of non-compliance and late filings

This route lets you establish a presence in Australia while focusing your resources on growth, rather than on administration.

How Leap29 can help

Leap29’s team specialises in supporting businesses entering the Australian market. Whether you choose a full entity setup, or prefer the flexibility of our Australia PEO services, we’ll guide you through tax, HR and compliance requirements so you can expand with confidence.

Speak to one of our Australian expansion experts today at +44 (0) 20 8129 6860 or email expansion@leap29.com to discuss the best route for your business.

Don’t take our word for it!

“

Talk to an expert today

Whatever stage you’re at in your global expansion journey, we can help.

Contact us today to see how Leap29 can be the trusted PEO partner that supports your global expansion.

"*" indicates required fields

Australia

Expansion Resources

Local expertise, global reach

Employ people compliantly in 180+ countries – with or without your own foreign entities. We can help you set up and manage foreign entities – or act as an Employer of Record. We can also help with multi-country payroll and all your HR management. Wherever, whenever and however you want to employ people, we can help.

180+

We make expansion in Australia simple

Employing people compliantly across international borders can be challenging but we make it simple, bringing down barriers and making light work of the complexities. We offer the full range of compliant global expansion solutions so that wherever, whenever and however you want to employ people, we can support you.

EOR Services

Employ people compliantly in 180+ countries – without setting up new entities. We’ll shoulder responsibility as Employer of Record (EOR), making sure all your international employment is fully compliant.

We can also take care of your global HR from multi-country payroll to onboarding and offboarding.

Payroll Solutions

Getting global payroll right is one of the hardest challenges for any business expanding into new countries. We can shoulder this burden, freeing up valuable in-house resource to focus on growing your business.

Consider us an extension of your HR team, ready to answer all your questions large and small.

Global Mobility

Mobilise your people across borders with ease. Relocating to work abroad can feel daunting. But with Leap29 at your side, your employees can feel safe and supported.

We’ll guide your employees through the complexities of working in another country, helping them settle in fast.

Entity Services

Follow the opportunities to grow your business – wherever they take you.

We lighten the load of establishing and managing foreign entities and can help you solve all your entity challenges from running compliant, accurate multi-country payroll to local accounting and financial reporting.

PEO Solutions

Employ international talent wherever and whenever you need it – and enjoy the peace of mind of knowing you’re fully compliant. Our Professional Employer Organisation (PEO) services allow you to focus on growing your business while we handle compliance, multi-country payroll and your global HR.

Support & Advisory

The help you need to make your global growth effortless – trusted guidance and advice on your expansion challenges large and small.

HR Support

When you’re employing people in lots of different countries, answering just a simple query can take a disproportionate amount of time for your in-house HR team. Our HR Support service reduces this burden, saving you time and money and giving you the confidence of knowing your employees are well looked after, whatever their location.

Contractor Payroll

Enjoy compliant contractor payroll that meets all local requirements for tax, social security and employment legislation. We understand the importance of compliant contractor payroll to the success of your business and will pay your contractors on time, every time.

Start hiring today – and onboard within hours.

Pricing

Budget confidently with transparent, competitive fees and no hidden costs.

Want us to shoulder employer liability and take care of your global HR through our EOR solution? No problem. Just want global payroll? You can have that too. Pick the solutions that your individual business needs.