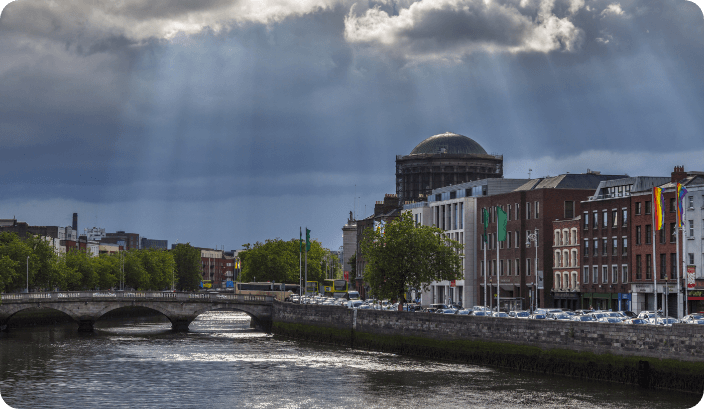

Global Expansion Resources | Ireland

Ireland Employment Contracts

Expand into Ireland with a specialist global PEO provider

Provide compliant Irish employment contracts for international hires with Leap29

Expanding your operations into Ireland could unlock a wealth of benefits for your business, including a skilled talent pool to recruit from, access to profitable EU (European Union) markets and a low corporate tax rate of just 12.5%.

But with global expansion comes great responsibility. Foreign employment law can be a minefield for companies who are new to the process, so compliance is key. That’s where Leap29’s global PEO (Professional Employer Organisation) solutions come in.

With over 25 years of experience in issuing compliant Irish employment contracts, processing multi-country payroll, fulfilling HR duties and more – we’ll handle all of the above on your behalf, so you can seize new opportunities and recruit local talent quickly, without the risk of non-compliance and the expense of single-handed global expansion hanging over your head.

Want to expand into Ireland?

Contact us today to see how Leap29 can be the trusted partner that supports your global expansion.

"*" indicates required fields

What’s included:

HR software

Bespoke employee management software included in our PEO service.

Global compliance

We have expert teams across the world to ensure global compliance.

Transparent pricing

Avoid hidden costs and account for our fee with our transparent pricing.

Ireland Expansion Advice

What does an Irish employment contract include?

An Irish employment contract must comply with the Employment (Miscellaneous Provisions) Act 2018 and therefore, must include:

- The full names of the employer and employee.

- The address of the employer.

- The place of work – if there is no fixed place of work, the employer must state the various locations the employee is able to work from, or state that the employee is free to choose the location(s) themselves.

- The date the employment started.

- The job title, grade or nature of the work.

- The expected duration of the contract (e.g. temporary or fixed-term).

- The rate or method of payment and the ‘pay reference period’ (e.g. whether the employee is paid weekly, fortnightly or monthly).

- The length of the employee’s working day and week (e.g. 8 hours per day, 5 days per week).

- The duration and conditions of the probation period (if applicable).

- Any terms and conditions relating to hours of work, e.g. overtime.

What types of employment contracts are there in Ireland?

Irish employment contracts are either full-time (usually 39 hours per week) or part-time (varies by employer), and can be indefinite or fixed-term:

- Indefinite: The most common type, indefinite employment contracts are open-ended, meaning they will continue until the employee or employer ends it by giving notice.

- Fixed-Term/’Specified Purpose’: This type of contract ends on a specific date or when the required task has been completed. These are usually used for temporary staff shortages or fixed-term projects.

Can I change an Irish employment contract?

Yes, but only after a mutual agreement between yourself and your employee. You must give them the details of this change in writing, by or before the day in which the change will take effect.

If your employee is going to work outside of Ireland, and the change is proposed to take place while they are away or upon their return, you must notify them in writing before they leave.

Why use a PEO partner to manage Ireland employment contracts?

Most companies don’t have the time, funding or resources to become a legal and HR expert in every country they conduct business in. That’s why you’ll need professional support when you’re issuing Irish employment contracts.

Partnering with a specialist PEO provider like Leap29 helps you:

- Stay compliant: Comply with the Employment (Miscellaneous Provisions) Act 2018, the Unfair Dismissals Act (1977-2015), the Payment of Wages Act (1991) and the Industrial Relations Acts (1946-1969).

- Focus on what matters: Free up valuable in-house resources to focus on the core management of your business.

- Prevent setbacks: Employ local talent quickly and compliantly, reducing your time to market.

- Avoid unnecessary costs: Prevent costly penalties or fines for non-compliance.

If you want to find out more about how our global PEO services in Ireland can support your global expansion, call our experts on +44 (0) 20 8129 6860 or email expansion@leap29.com to get started.

Don’t take our word for it!

“

Ireland Employment Contracts FAQs

What is the difference between ‘express’ and ‘implied’ terms on Irish employment contracts?

‘Express’ terms on Irish employment contracts are agreed between you and your employer.

- ‘Express’ Terms: Can either be verbally agreed or set out in writing within the contract itself or a staff handbook for example. Generally includes pay, hours of work, notice period, etc.

- ‘Implied’ Terms: Not verbally agreed to or set out in writing, but are still legally binding, e.g. terms from relevant legislation and case law, custom and practice within the workplace, etc.

What’s the difference between a contract of service and a contract for services in Ireland?

A contract of service applies to employees, whereas a contract for services applies to self-employed contractors. Here’s a more detailed comparison:

- Contract of service: An employee works under the employer’s direction, meaning the employer decides how, when and where the work is performed. The employee receives statutory employment rights/benefits and the employer is responsible for deducting Income Tax/PRSI (Pay Related Social Insurance) through the PAYE system.

- Contract for services: An independent contractor who is self-employed under their own direction, meaning they decide how the work is done (usually for multiple clients). The contractor does not have the same employment rights or statutory protections as an employee working under a contract of service. They are responsible for their own tax obligations, including registering for self-assessment and charging VAT (if applicable).

Are remote or hybrid work terms covered in Irish employment contracts?

Yes, Irish employment contracts must cover remote or hybrid work terms if applicable. Key contract elements include:

- Place of work: The contract must specify where the employee will be working.

- Working hours & overtime: When setting working hours and overtime conditions, you must adhere to the Organisation of Working Time Act, 1997 and the EU Working Time Directive (2003/88/EC)

- Equipment & expenses: The employer must outline which (if any) equipment will be provided by them and any other contributions towards home office expenses (i.e. the tax-free allowance between €1.50 and €3.20 per day, which depends on employer policies, home working frequency and overall employee support strategies).

- Health & safety: Employers have a duty of care to ensure their employees’ workspace is safe to work in.

- Data security: The contract should refer to data protection policies that are crucial to remote working.

Talk to an expert today

Whatever stage you’re at in your global expansion journey, we can help.

Contact us today to see how Leap29 can be the trusted EOR partner that supports your global expansion.

"*" indicates required fields

Ireland

Expansion Resources

Local expertise, global reach

Employ people compliantly in 180+ countries – with or without your own foreign entities. We can help you set up and manage foreign entities – or act as an Employer of Record. We can also help with multi-country payroll and all your HR management. Wherever, whenever and however you want to employ people, we can help.

180+

We make expansion in Ireland simple

Employing people compliantly across international borders can be challenging but we make it simple, bringing down barriers and making light work of the complexities. We offer the full range of compliant global expansion solutions so that wherever, whenever and however you want to employ people, we can support you.

EOR Services

Employ people compliantly in 180+ countries – without setting up new entities. We’ll shoulder responsibility as Employer of Record (EOR), making sure all your international employment is fully compliant.

We can also take care of your global HR from multi-country payroll to onboarding and offboarding.

Payroll Solutions

Getting global payroll right is one of the hardest challenges for any business expanding into new countries. We can shoulder this burden, freeing up valuable in-house resource to focus on growing your business.

Consider us an extension of your HR team, ready to answer all your questions large and small.

Global Mobility

Mobilise your people across borders with ease. Relocating to work abroad can feel daunting. But with Leap29 at your side, your employees can feel safe and supported.

We’ll guide your employees through the complexities of working in another country, helping them settle in fast.

Entity Services

Follow the opportunities to grow your business – wherever they take you.

We lighten the load of establishing and managing foreign entities and can help you solve all your entity challenges from running compliant, accurate multi-country payroll to local accounting and financial reporting.

PEO Solutions

Employ international talent wherever and whenever you need it – and enjoy the peace of mind of knowing you’re fully compliant. Our Professional Employer Organisation (PEO) services allow you to focus on growing your business while we handle compliance, multi-country payroll and your global HR.

Support & Advisory

The help you need to make your global growth effortless – trusted guidance and advice on your expansion challenges large and small.

HR Support

When you’re employing people in lots of different countries, answering just a simple query can take a disproportionate amount of time for your in-house HR team. Our HR Support service reduces this burden, saving you time and money and giving you the confidence of knowing your employees are well looked after, whatever their location.

Contractor Payroll

Enjoy compliant contractor payroll that meets all local requirements for tax, social security and employment legislation. We understand the importance of compliant contractor payroll to the success of your business and will pay your contractors on time, every time.

Start hiring today – and onboard within hours.

Pricing

Budget confidently with transparent, competitive fees and no hidden costs.

Want us to shoulder employer liability and take care of your global HR through our EOR solution? No problem. Just want global payroll? You can have that too. Pick the solutions that your individual business needs.