Global Expansion Resources | Ireland

Ireland Entity Setup

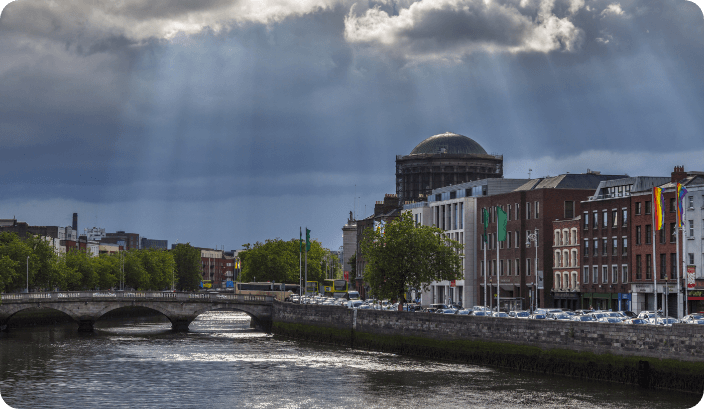

Expand into Ireland with confidence

Expand into new markets with the leading Irish EOR partner

Thinking of setting up a business in Ireland? With one of the lowest corporate tax rates in Europe, an English-speaking workforce and full EU market access, Ireland continues to attract international businesses of all sizes. But before hiring staff or opening an office, you’ll need to decide whether to establish a legal entity or work with a PEO (Professional Employer Organisation).

Both routes give you a presence in Ireland, but the level of commitment, compliance and cost is very different.

Want to expand into Ireland?

Contact us today to see how Leap29 can be the trusted partner that supports your global expansion.

"*" indicates required fields

What’s included:

HR software

Bespoke employee management software included in our PEO service.

Global compliance

We have expert teams across the world to ensure global compliance.

Transparent pricing

Avoid hidden costs and account for our fee with our transparent pricing.

Ireland Expansion Advice

Who needs to set up an entity in Ireland?

If you’re planning to trade directly in Ireland, hire employees, or open a physical office, you’ll need to establish a registered company. Doing so ensures you comply with Irish tax rules and employment laws, while also giving your business credibility with local stakeholders.

If your only link to Ireland is through independent contractors, and you’re not actively running business operations in the country, a legal entity isn’t usually required.

Common types of Irish subsidiaries

When foreign companies expand into Ireland, the most typical entity structures are:

- Private Company Limited by Shares (LTD) – the most common type, with limited liability for shareholders.

- Designated Activity Company (DAC) – often chosen if the business has specific, pre-defined goals and activities it must stick to, such as fund management companies and structured finance entities.

- Branch office – a simpler option that extends the parent company into Ireland, though it doesn’t provide the same level of liability protection as an LTD.

The right option depends on how you plan to operate, how much flexibility you need and the level of risk you’re willing to carry.

How to register a company in Ireland

Setting up a subsidiary in Ireland involves several steps, including:

- Registering with the Companies Registration Office (CRO)

- Submitting the company constitution and incorporation forms

- Providing details of directors and shareholders (at least one EEA-resident director is required, unless you obtain a bond)

- Registering with the Revenue Commissioners for corporation tax, VAT and employer PAYE

- Opening a local bank account

- Securing a registered office address in Ireland

Depending on your sector, you may also need regulatory approval before starting operations.

Irish legal entity compliance obligations

Once incorporated, Irish entities face ongoing compliance obligations, including:

- Filing annual returns with the CRO

- Preparing statutory financial statements

- Maintaining company registers (directors, shareholders and charges)

- Meeting employer obligations such as PRSI (Pay Related Social Insurance) contributions and employment contracts aligned with Irish law

Failure to meet deadlines can lead to fines, director disqualification, or additional administrative burden, so accurate record-keeping is critical.

What are the benefits of setting up a business in Ireland?

Ireland’s appeal as a hub for international business is clear:

- 12.5% corporate tax rate on trading income

- Access to the EU single market, including free movement of goods, services and people

- A skilled, English-speaking workforce with strong links to the US and Europe

- A reputation as a global hub for technology, pharmaceutical and financial services

For businesses with long-term plans in Europe, an Irish subsidiary can be a highly strategic base.

Why use a PEO instead of setting up a legal entity in Ireland?

While a legal entity gives you permanence, it also comes with cost, time commitments and ongoing compliance. If you want to test the Irish market, hire quickly, or expand without heavy administration, a PEO can be the smarter option.

Through a PEO, you can:

- Hire employees in Ireland without setting up a company

- Manage payroll, taxes and HR compliance seamlessly

- Scale up or down quickly depending on business performance

- Avoid the risks of non-compliance and late filings

This route lets you establish a presence in Ireland while focusing your resources on growth, rather than on administration.

How Leap29 can help

-

Leap29’s team specialises in supporting businesses entering the Irish market. Whether you choose a full entity setup or prefer the flexibility of our Ireland PEO services, we’ll guide you through tax, HR and compliance requirements so you can expand with confidence.

Speak to one of our Ireland expansion experts today at +44 (0) 20 8129 6860 or email expansion@leap29.com to discuss the best route for your business.

Don’t take our word for it!

“

Talk to an expert today

Whatever stage you’re at in your global expansion journey, we can help.

Contact us today to see how Leap29 can be the trusted EOR partner that supports your global expansion.

"*" indicates required fields

Ireland

Expansion Resources

Local expertise, global reach

Employ people compliantly in 180+ countries – with or without your own foreign entities. We can help you set up and manage foreign entities – or act as an Employer of Record. We can also help with multi-country payroll and all your HR management. Wherever, whenever and however you want to employ people, we can help.

180+

We make expansion in Ireland simple

Employing people compliantly across international borders can be challenging but we make it simple, bringing down barriers and making light work of the complexities. We offer the full range of compliant global expansion solutions so that wherever, whenever and however you want to employ people, we can support you.

EOR Services

Employ people compliantly in 180+ countries – without setting up new entities. We’ll shoulder responsibility as Employer of Record (EOR), making sure all your international employment is fully compliant.

We can also take care of your global HR from multi-country payroll to onboarding and offboarding.

Payroll Solutions

Getting global payroll right is one of the hardest challenges for any business expanding into new countries. We can shoulder this burden, freeing up valuable in-house resource to focus on growing your business.

Consider us an extension of your HR team, ready to answer all your questions large and small.

Global Mobility

Mobilise your people across borders with ease. Relocating to work abroad can feel daunting. But with Leap29 at your side, your employees can feel safe and supported.

We’ll guide your employees through the complexities of working in another country, helping them settle in fast.

Entity Services

Follow the opportunities to grow your business – wherever they take you.

We lighten the load of establishing and managing foreign entities and can help you solve all your entity challenges from running compliant, accurate multi-country payroll to local accounting and financial reporting.

PEO Solutions

Employ international talent wherever and whenever you need it – and enjoy the peace of mind of knowing you’re fully compliant. Our Professional Employer Organisation (PEO) services allow you to focus on growing your business while we handle compliance, multi-country payroll and your global HR.

Support & Advisory

The help you need to make your global growth effortless – trusted guidance and advice on your expansion challenges large and small.

HR Support

When you’re employing people in lots of different countries, answering just a simple query can take a disproportionate amount of time for your in-house HR team. Our HR Support service reduces this burden, saving you time and money and giving you the confidence of knowing your employees are well looked after, whatever their location.

Contractor Payroll

Enjoy compliant contractor payroll that meets all local requirements for tax, social security and employment legislation. We understand the importance of compliant contractor payroll to the success of your business and will pay your contractors on time, every time.

Start hiring today – and onboard within hours.

Pricing

Budget confidently with transparent, competitive fees and no hidden costs.

Want us to shoulder employer liability and take care of your global HR through our EOR solution? No problem. Just want global payroll? You can have that too. Pick the solutions that your individual business needs.