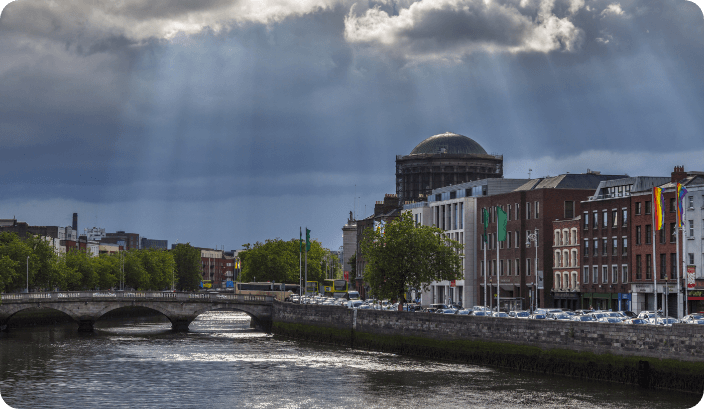

Global Expansion Resources | Ireland

Ireland Payroll Solutions

Seamlessly integrate our Ireland payroll services with your business.

Running payroll in Ireland can feel complicated, especially with systems like PAYE, PRSI, the Universal Social Charge (USC) and Real Time Reporting to manage. On top of that, employers must handle written contracts, payslips, annual leave and workplace safety standards. It’s a lot to keep on top of and mistakes can be costly.

Leap29 takes that pressure away. With more than 25 years of global experience across 180+ countries, we handle every part of your Irish payroll – from Revenue registration to monthly submissions and employee payments. We’ll make sure your people are paid correctly, your business stays compliant and your time is spent where it matters most.

Want to expand into Ireland?

Contact us today to see how Leap29 can be the trusted partner that supports your global expansion.

"*" indicates required fields

What’s included:

HR software

Bespoke employee management software included in our PEO service.

Global compliance

We have expert teams across the world to ensure global compliance.

Transparent pricing

Avoid hidden costs and account for our fee with our transparent pricing.

Ireland Expansion Advice

Payroll Compliance in Ireland

When employing staff in Ireland, companies must meet several statutory requirements. Key areas include:

- Employer registration: All employers must register with the tax authorities, Irish Revenue, before they can process payroll or make tax deductions.

- PAYE (Pay As You Earn): Income tax, PRSI and USC must be deducted from each employee’s wages and paid to Revenue.

- Real Time Reporting (RTR): Every payroll submission must be reported to Revenue on or before the employee’s pay date.

- Payslips: Employers must issue itemised payslips showing gross pay, deductions and net pay.

- Minimum wage: Most workers are entitled to a minimum hourly rate of €13.50, with specific rates for younger workers and apprentices.

- Working hours and breaks: The Organisation of Working Time Act 1997 and the EU Working Time Directive (2003/88/EC) limits working hours and ensures employees receive daily and weekly rest breaks.

- Leave entitlements: Employees are entitled to four weeks of paid annual leave per year, plus public holidays. Additional protective leave includes maternity, paternity, parental, carer’s, sick and domestic violence leave.

- Health and safety: Employers must ensure a safe workplace under the Safety, Health and Welfare at Work Act 2005. Risk assessments and safety statements are mandatory.

- Data protection and record keeping: Payroll data must comply with GDPR. Employers must keep accurate records of working hours, pay rates and deductions for inspection by the Workplace Relations Commission.

Leap29’s payroll team ensures all of these requirements are handled accurately, helping your business stay fully compliant with Irish employment and tax law.

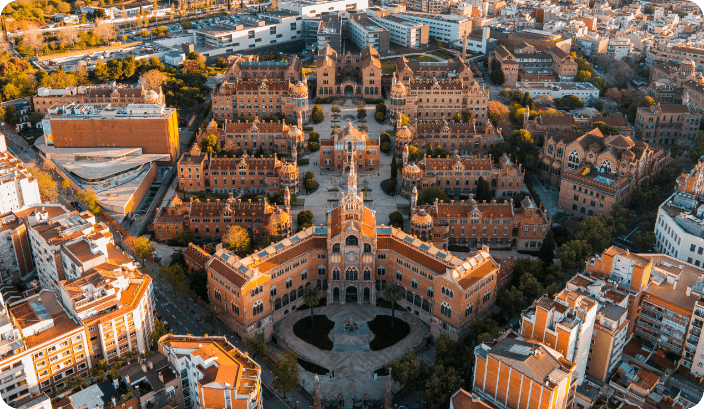

Why Expand into Ireland?

Ireland remains a leading destination for global investment, offering a highly skilled workforce, competitive tax environment and strong access to international markets.

Key advantages include:

- Business-friendly tax system: Corporate tax rate of 12.5% on trading income, among the lowest in the EU.

- Global connectivity: Direct trade and transport links to the EU, UK and North America.

- Skilled labour market: Ireland offers a highly educated, multilingual talent pool in technology, life sciences, engineering and financial services.

- Innovation incentives: R&D tax credits, grants and government schemes support business growth and research investment.

- Stable regulatory framework: Transparent employment and tax laws supported by strong digital reporting systems.

While Ireland offers a supportive business climate, managing payroll and HR compliance requires attention to evolving legislation. Leap29’s local payroll experts handle every aspect, from Revenue submissions to annual leave tracking, so you can focus on growth.

Leap29 Payroll Services in Ireland

We provide a comprehensive payroll solution for companies hiring in Ireland. Our services include:

- Salary and tax calculation

- Payslip creation and employee self-service access

- PAYE, PRSI and USC deductions and submissions

- Real Time Reporting (RTR) to Revenue

- Pension and benefit administration

- Statutory leave and holiday tracking

- Employee expense management

- Multi-currency payroll and cross-border payments

Leap29 combines local Irish expertise with international coverage, giving you a compliant and transparent payroll process no matter where your team operates.

Why Work With Leap29?

Choosing Leap29 means:

- 25+ years of global payroll experience with in-depth Irish expertise

- 99.99% payroll accuracy rate

- Transparent pricing and clear reporting

- Integration with your HR and finance systems

- Dedicated support from local payroll specialists backed by a global team

We work with companies across a range of sectors, including:

Ready to Simplify Payroll in Ireland?

Speak to our team today at +44 (0) 20 8129 6860 or email expansion@leap29.com to discuss how we can support your operations in Ireland.

You can also try our Employee Cost Calculator to estimate the total cost of hiring in Ireland in just a few clicks.

Don’t take our word for it!

“

Irish Payroll FAQs

What does payroll outsourcing in Ireland include?

Our Ireland payroll service covers salary and tax calculations, payslip generation, PAYE/PRSI/USC deductions, Revenue submissions, benefits and statutory leave management. We handle all compliance and reporting obligations so your business stays fully aligned with Irish law.

How often must payroll be reported to Revenue?

Employers must submit payroll data to Revenue on or before each payment date under the Real Time Reporting system. Leap29 can help simplify this process to ensure accuracy and timeliness.

What is the minimum wage in Ireland?

As of 2025, the national minimum wage is €13.50 per hour increasing to €14.15 in 2026 . Rates vary for employees under 20 or in structured apprenticeship schemes.

Are Irish employers required to give payslips?

Yes. All employees must receive detailed payslips showing their gross pay, deductions (tax, PRSI, USC) and net pay.

Talk to an expert today

Whatever stage you’re at in your global expansion journey, we can help.

Contact us today to see how Leap29 can be the trusted EOR partner that supports your global expansion.

"*" indicates required fields

Ireland

Expansion Resources

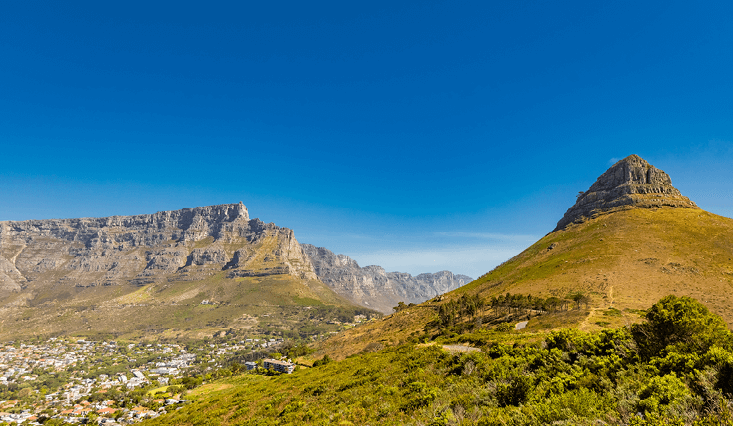

Local expertise, global reach

Employ people compliantly in 180+ countries – with or without your own foreign entities. We can help you set up and manage foreign entities – or act as an Employer of Record. We can also help with multi-country payroll and all your HR management. Wherever, whenever and however you want to employ people, we can help.

180+

We make expansion in Ireland simple

Employing people compliantly across international borders can be challenging but we make it simple, bringing down barriers and making light work of the complexities. We offer the full range of compliant global expansion solutions so that wherever, whenever and however you want to employ people, we can support you.

EOR Services

Employ people compliantly in 180+ countries – without setting up new entities. We’ll shoulder responsibility as Employer of Record (EOR), making sure all your international employment is fully compliant.

We can also take care of your global HR from multi-country payroll to onboarding and offboarding.

Payroll Solutions

Getting global payroll right is one of the hardest challenges for any business expanding into new countries. We can shoulder this burden, freeing up valuable in-house resource to focus on growing your business.

Consider us an extension of your HR team, ready to answer all your questions large and small.

Global Mobility

Mobilise your people across borders with ease. Relocating to work abroad can feel daunting. But with Leap29 at your side, your employees can feel safe and supported.

We’ll guide your employees through the complexities of working in another country, helping them settle in fast.

Entity Services

Follow the opportunities to grow your business – wherever they take you.

We lighten the load of establishing and managing foreign entities and can help you solve all your entity challenges from running compliant, accurate multi-country payroll to local accounting and financial reporting.

PEO Solutions

Employ international talent wherever and whenever you need it – and enjoy the peace of mind of knowing you’re fully compliant. Our Professional Employer Organisation (PEO) services allow you to focus on growing your business while we handle compliance, multi-country payroll and your global HR.

Support & Advisory

The help you need to make your global growth effortless – trusted guidance and advice on your expansion challenges large and small.

HR Support

When you’re employing people in lots of different countries, answering just a simple query can take a disproportionate amount of time for your in-house HR team. Our HR Support service reduces this burden, saving you time and money and giving you the confidence of knowing your employees are well looked after, whatever their location.

Contractor Payroll

Enjoy compliant contractor payroll that meets all local requirements for tax, social security and employment legislation. We understand the importance of compliant contractor payroll to the success of your business and will pay your contractors on time, every time.

Start hiring today – and onboard within hours.

Pricing

Budget confidently with transparent, competitive fees and no hidden costs.

Want us to shoulder employer liability and take care of your global HR through our EOR solution? No problem. Just want global payroll? You can have that too. Pick the solutions that your individual business needs.