Global Expansion Resources | Malaysia

Malaysia Payroll Solutions

Specialist Malaysia Payroll Solutions: Guaranteeing compliance for your internationally expanding business

Issue compliant payroll with ease using our comprehensive Malaysia payroll solutions

It’s no surprise that expanding globally is a highly lucrative prospect for any successful business. But it also means ensuring strict regulatory compliance, preventing costly mistakes and streamlining your operations to avoid delays as much as possible.

That’s where Leap29 comes in. With a skilled team of global expansion experts and over 25 years of experience across 180+ countries, our specialist Malaysia payroll solutions are guaranteed to help your company dominate the international business scene.

As part of our comprehensive PEO (Professional Employer Organisation) services and global payroll solutions, we also offer support with:

- HR duties

- Issuing compliant employment contracts

- Tax & social security obligations

- Country-specific employee benefits

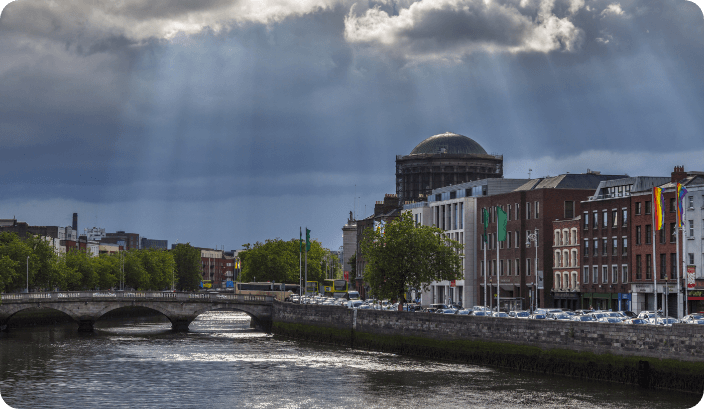

Whether it’s handling multi-currency transactions across different time zones, or paying your Malaysia-based employees in an accurate and timely manner – our dedicated payroll solutions will handle all of the country-specific complexities for you, while you focus your energy on the core management of your business. Situated in the heart of Southeast Asia, Malaysia provides access to a large regional market that is extremely attractive for businesses and serves as a gateway to other Southeast Asian countries, including Singapore, Thailand and Vietnam. Malaysia’s welcoming attitude towards foreign investment and simplified business processes has made it easier than ever for companies to establish themselves in this booming Asian market.

Want to expand into Malaysia?

Contact us today to see how Leap29 can be the trusted partner that supports your global expansion.

"*" indicates required fields

What’s included:

HR software

Bespoke employee management software included in our PEO service.

Global compliance

We have expert teams across the world to ensure global compliance.

Transparent pricing

Avoid hidden costs and account for our fee with our transparent pricing.

Malaysia Expansion Advice

How do I run payroll compliantly in Malaysia?

To run payroll compliantly in Malaysia, your business will need to:

- Register your company at the Companies Commission of Malaysia: This is the first step as you’ll need to reserve a company name, go through the setup process and open an in-country bank account to pay your Malaysia-based employees.

- Register with the Inland Revenue Board (IRB), the Employees’ Provident Fund (EPF) and the Human Resources Development Fund (HRDF): The IRB handles tax, while the EPF manages pensions and the HRDF collects compulsory levies from employers to fund training/skills development programmes for Malaysian employees (if applicable).

- Register with the Social Security Organisation (SOCSO) when your first employee joins the company: Employees and employers must contribute monthly to the SOCSO (or Pertubuhan Keselamatan Sosial/PERKESO as it’s known in Malaysia), which helps in the event of death, disability or illness. Employers must register with the SOCSO office within 30 days from the date the new employee joins.

- Provide employees with a written employment contract: The Malaysian Employment Act 1955 mandates written employment contracts for assignments lasting longer than one month, or for work expected to take more than a month. Learn more about Leap29’s Malaysian Employment Contract services via our website.

- Provide employees with annual EA forms: The purpose of annual EA forms is to allow Malaysian employees to file their own taxes properly and declare their earnings to the IRB (or the Lembaga Hasil Dalam Negeri/LHDN as it’s known in Malaysia). It is mandatory for the employer to provide this, regardless of whether the term of employment is permanent, fixed-term or part-time.

Attempting to tackle Malaysia’s strict taxation policies and complex business registration process without an expert by your side can pose a multitude of compliance risks, putting your company’s reputation under threat and ultimately delaying your time to market.

But with Leap29 as your dedicated PEO provider, what seemed impossible in the beginning becomes achievable within a realistic timescale, tailored to your business.

What are the advantages of expanding your business into Malaysia and how can Leap29’s global payroll solutions support your expansion?

Setting up a business in Malaysia offers many advantages, including:

- Low corporate tax rates: The corporate tax rate in Malaysia is 24%, unless your business meets certain requirements (e.g. meeting a threshold for the amount of paid-up capital that your business, or any entities your business controls, has) in which case this lowers to 17%.

- Companies Act (2016): Introduced in 2016, Malaysia’s new Companies Act has made registering a company in the country more straightforward and cost-effective. These changes mean you can create companies with just one owner/leader and exclude audits for inactive companies, making it easier to approve written resolutions.

- Strategic location: Malaysia’s infrastructure and trade networks are well-developed, with seven seaports, six international airports and an extensive road and rail network across the country.

- Free trade agreements: Malaysia has actively participated in various free trade agreements, both bilateral and regional, with several countries across the world. This includes Japan, Pakistan, New Zealand, India, Chile, Australia and Turkey.

However, expanding into Malaysia also comes with the task of adapting to a completely different payroll system with its own individual needs. This means strict requirements, including total statutory compliance with the LHDN, EPF and SOCSO.

To ensure a successful and compliant expansion, you’ll need a reliable PEO provider alongside you. Leap29’s comprehensive PEO services can help you manage everything from HR duties and tax obligations, to issuing lawful employment contracts and, of course, compliant payroll – whether you’re paying a single employee, or an entire workforce.

Why choose Leap29 for payroll services in Malaysia?

Leap29’s Malaysia payroll services provide 99.99% accuracy, guaranteed compliance and transparent pricing with no hidden fees.

With over 25 years of experience across more than 180 countries, Leap29 have supported global expansions for a versatile range of sectors, including but not limited to:

- Aerospace

- Construction & Engineering

- Education

- Life Sciences & Pharmaceuticals

- Manufacturing

- Medical & Healthcare

- Oil & Gas

- Renewable Energy

- Technology

- Transport & Logistics

To find out more about how our Malaysia Payroll Solutions can support your global expansion, call our experts today on +44 (0) 20 8129 6860 or email us at expansion@leap29.com.

Try our Employee Cost Calculator to find out the costs of employing internationally. Simply enter your chosen country and base salary, then see the number on-screen instantly!

Don’t take our word for it!

“

Malaysia Payroll Solutions FAQs

What do Leap29’s Malaysia payroll solutions include?

Leap29’s Malaysia payroll solutions can include:

- Calculating employee salaries (including the 13th month salary and performance bonuses, if applicable)

- Creating and issuing monthly, weekly or bi-weekly payslips

- Calculating tax-free allowances and applicable tax rates

- Filing and submitting annual employee EA forms to the Malaysian tax authorities – i.e. Lembaga Hasil Dalam Negeri (LHDN)

- Complying with immigration, tax and Pertubuhan Keselamatan Sosial (PERKESO) social security legislation

- Processing multi-currency payments with minimal administration

- Complying with Malaysian employment laws regarding contracts, taxation, termination, leave and any applicable employee benefits/insurance

How much do Leap29’s Malaysia payroll solutions cost?

Leap29’s Malaysia payroll services start at $15 per employee/month. For that cost, you get:

- 99.99% payroll accuracy

- Optional API integrations with your HR, finance and accounting packages

- Local, regional and HQ-level support from our payroll experts

- A visual presentation of your data to help drive more informed business decisions

If required, you may also add on additional services, such as tax and labour authority handling, compliance management and extra HR support. Visit Leap29’s pricing for more information.

What are the benefits of Leap29’s Malaysia payroll solutions?

Expanding globally can take an unnecessary toll on growing businesses. But with Leap29’s Malaysia payroll solutions, your company can:

- Ensure compliance with Malaysian employment laws: Feel confident you’re meeting Malaysia’s statutory requirements with an expert PEO team, who have over 25 years of experience in dealing with Malaysia’s tax, employment and social security systems.

- Prevent legal disputes and unhappy employees: With 99.99% payroll accuracy, your Malaysia-based employees can rest assured they’ll always be paid the right amount, at the right time – preventing legal disputes and unhappy staff from hindering your business’ expansion.

Take the strain off internal HR resources: Your in-house HR team may lack the capacity and resources for multi-country payroll. If you need to hire quickly and compliantly without setting up a legal entity, a PEO provider can take the strain off your internal team. Learn more about the benefits of an EOR (Employer of Record) vs In-House HR via our global expansion blog.

Talk to an expert today

Whatever stage you’re at in your global expansion journey, we can help.

Contact us today to see how Leap29 can be the trusted EOR partner that supports your global expansion.

"*" indicates required fields

Malaysia

Expansion Resources

Local expertise, global reach

Employ people compliantly in 180+ countries – with or without your own foreign entities. We can help you set up and manage foreign entities – or act as an Employer of Record. We can also help with multi-country payroll and all your HR management. Wherever, whenever and however you want to employ people, we can help.

180+

We make expansion in Malaysia simple

Employing people compliantly across international borders can be challenging but we make it simple, bringing down barriers and making light work of the complexities. We offer the full range of compliant global expansion solutions so that wherever, whenever and however you want to employ people, we can support you.

EOR Services

Employ people compliantly in 180+ countries – without setting up new entities. We’ll shoulder responsibility as Employer of Record (EOR), making sure all your international employment is fully compliant.

We can also take care of your global HR from multi-country payroll to onboarding and offboarding.

Payroll Solutions

Getting global payroll right is one of the hardest challenges for any business expanding into new countries. We can shoulder this burden, freeing up valuable in-house resource to focus on growing your business.

Consider us an extension of your HR team, ready to answer all your questions large and small.

Global Mobility

Mobilise your people across borders with ease. Relocating to work abroad can feel daunting. But with Leap29 at your side, your employees can feel safe and supported.

We’ll guide your employees through the complexities of working in another country, helping them settle in fast.

Entity Services

Follow the opportunities to grow your business – wherever they take you.

We lighten the load of establishing and managing foreign entities and can help you solve all your entity challenges from running compliant, accurate multi-country payroll to local accounting and financial reporting.

PEO Solutions

Employ international talent wherever and whenever you need it – and enjoy the peace of mind of knowing you’re fully compliant. Our Professional Employer Organisation (PEO) services allow you to focus on growing your business while we handle compliance, multi-country payroll and your global HR.

Support & Advisory

The help you need to make your global growth effortless – trusted guidance and advice on your expansion challenges large and small.

HR Support

When you’re employing people in lots of different countries, answering just a simple query can take a disproportionate amount of time for your in-house HR team. Our HR Support service reduces this burden, saving you time and money and giving you the confidence of knowing your employees are well looked after, whatever their location.

Contractor Payroll

Enjoy compliant contractor payroll that meets all local requirements for tax, social security and employment legislation. We understand the importance of compliant contractor payroll to the success of your business and will pay your contractors on time, every time.

Start hiring today – and onboard within hours.

Pricing

Budget confidently with transparent, competitive fees and no hidden costs.

Want us to shoulder employer liability and take care of your global HR through our EOR solution? No problem. Just want global payroll? You can have that too. Pick the solutions that your individual business needs.